For the large majority of traders, the plan is to see a stock rise in value after taking a position. There are the cases of so-called “shorts” that profit by the stock price dropping, but that’s a topic for another article. Every single trade needs to be planned out, which means having an exit strategy regardless of the stock’s direction subsequent to buying some. While we all want to see every stock appreciate, that doesn’t always happen, so that means preparing for the downside as well.

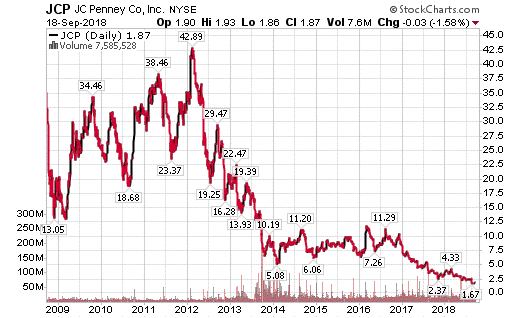

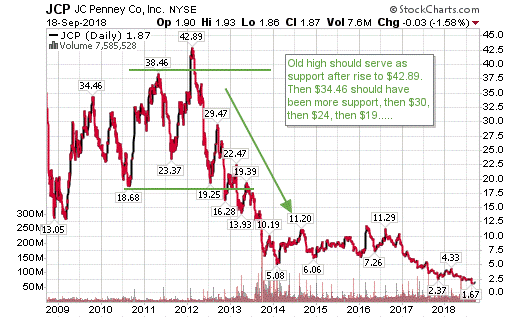

We’re not going to even use some of the worst examples of stocks failing to get traction. That can be penny stocks that literally become 100% worthless or companies that go bankrupt for example. Just take a look at JC Penney Co. (NYSE:JCP), a New York Stock Exchange company and iconic retailer. Shares reached $42.89 in early 2012. Traders were likely cheering, thinking the stock was going to keep gaining in value.

Then look what happened. As of September 2018 (the time of this writing), shares are still sinking, printing $1.87 as of the close on Sept. 18. That’s a loss of 95.6% from the high. There are many examples like this and many more of stocks that went through substantial downturns and recovered, but never made it back to the high.

Take the Loss Smartly

Taking a loss is one thing; that happens to every investor. There is nothing worse, though, than hanging on and watching a small loss become a bigger loss and then a complete portfolio destroyer. Not to make light of anything, but taking the trading loss is a whole process somewhat akin to the seven stages of grief associated with death (It’s not the same, we know, but you get the point). Traders will go through denial (“It will come back”), bargaining (Looking to a higher power to help: “Just have it gain some to cut my loss, please.”), depression (“I’m terrible at trading and quitting.”) and finally acceptance (“I’ll learn from it.”), amongst the others. If you’re a seasoned trader reading this, chances are that you’ve got a smirk on your face thinking to yourself, “Yup, been there; done that.”

Anyway, in that process there is testing (at least in the modified Kubler-Ross model), which has to do with seeking realistic solutions. The solution is actually quite simple: use a stop/loss.

A stop/loss is an order placed with a broker telling them at what point you want to cut losses and exit a position. It is the most simple and efficient tool in loss prevention that, sadly, often gets overlooked. For example, let’s say you bought Amazon at $2,000 and are only willing to accept a 10% loss in your portfolio. You simply direct your broker to sell if shares of AMZN drop below $1,800. If shares turn south and $1,800 is broken, your broker will make the sale at the prevailing market price, making all attempts to keep your sell price as close to $1,800 as possible.

Set It and Forget It

While setting a stop/loss needs to be an integral part to every trade strategy, where to place it is arbitrary and dependent on a trader’s risk appetite. Stop/losses could be based on fundamental analysis (comparisons to peers regarding price-to-earnings ratios, cash on hand, enterprise value, and countless others), technical analysis (evaluating a stock chart) or a combination. Often fundamentals align with technicals, so a combination is often the best plan.

By definition, technical support attracts buyers based upon what the market deems is a fair or even bargain price for a stock (or any financial asset for that matter).

That tells a trader to look for strong support levels and if they don’t hold, for some reason, the market has changed its opinion on what is a fair price to acquire shares. To that end, it may be time to exit the trade and let the market decide where the bottom should be.

That tells a trader to look for strong support levels and if they don’t hold, for some reason, the market has changed its opinion on what is a fair price to acquire shares. To that end, it may be time to exit the trade and let the market decide where the bottom should be.

Using JCP as an example once again, notice that once the stock made the high and started to retrace, it didn’t hold any levels of support in its descent. Traders may have been fooled when the stock slipped all the way back to around $19. Surely, that’s an area of good support, right? After all, the stock had been more than halved from its high, $18.68 held as support on the uptrend and $19.25 held on the downtrend.

Wrong. And if you had jumped in there (which wouldn’t have been a bad technical decision) without planning an exit, you’d be down about 90% right now. A stop/loss on the break of $18.68 would have prevented that.

Any Downside to Stop/Losses?

There is a true negative to speak of when it comes to stop/losses. That is the potential for short-term volatility leading to sharp price movements that could trigger a stop/loss. There are some strategies that can help this, such as not setting a 10% stop/loss for a stock that has a pattern of swinging 20% in a day. However, there is nothing set in stone on this matter and it is just part of the trading machine.

If you are concerned about volatility, then use a “mental” stop/loss, meaning that you pick the sell price upon entering the trade and use a device to provide you a notification that the stock has fallen below that level. If you think it is just an intraday volatility, make your decision at that time or even wait until the end of the day to see the stock’s closing price. If it’s below that stop/loss, make the sale to be safe. If you start playing the “It’ll come back game,” you may just one day find yourself out of money and the market altogether.

One Last Word on Stop/Losses

A stop/loss is most generally known for its ability to mitigate losses (hence, the name), but that is not always completely accurate. A trailing stop/loss is used once a stock has gained. For example, say Biotech XYZ stock is bought at $10 and it runs to $20. They just got market approval for a new drug and you think it’s still going higher. In order to play it that way, a trailing stop/loss can be used for, say, 20% below the current price. So, if the stock falls under $16, the sell is triggered, but you still bank a profit of 60%.

About AllPennyStocks.com:

AllPennyStocks.com Media, Inc., founded in 1999, is one of North America’s largest and most comprehensive small-cap / penny stock financial portals. With Canadian and U.S. focused penny stock features and content, the site offers information for novice investors to expert traders. Outside of the countless free content available to visitors, AllPennyStocks.com Pro caters to traders looking for that trading edge by offering monthly stock picks, daily penny stock to watch trade ideas, market commentary and more.

Copyright © 2020 AllPennyStocks.com. All rights reserved. Republication or redistribution of AllPennyStocks.com's content is expressly prohibited without the prior written consent of AllPennyStocks.com. AllPennyStocks.com shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.